The question keeps getting asked - what happens if the debt with all these Council loans isn’t paid ? How will this affect ratepayers and renters ?

The question keeps getting asked - what happens if the debt with all these Council loans isn’t paid ? How will this affect ratepayers and renters ?

We thought we’d look into that, and we didn’t like what we found – AT ALL.

We hope this story is a catalyst where many, many, Ratepayers and Renters tell the NPDC you do not want them taking on more debt.

- We’ve covered off the $364 million debt the NPDC had managed to accumulate by 2024.

- We’ve done a story on Climate Adaptation – which will borrow large amounts more for ratepayers and renters to pay.

- We’ve done a story on Water Done Well – which will allow significantly more money to be borrowed under a new Water Company structure.

- This will be new debt on top of the $364 Million debt NPDC already has in place.

- This will be significantly more debt for the entire region of Taranaki, if a joint Water Council Controlled Organisation is established at the end of April 2025. (See our story in late April).

We’ve been asking people to send a submission on Climate Adaptation and Water Done Well which are open for public consultation now.

- If you haven’t already been convinced to put pen to paper – then we truly hope this story changes your mind.

This situation is like our original NPDC debt story, how do we let people know what is going on when they are not likely to be happy about it.

We don’t write these stories to upset people. We write these stories because ratepayers (and by association renters) are the people who get to wear the results of what Local and Central Government politicians decide to do. And we write these stories so you are aware of the issues and can take steps to change how our Council is being run.

We are going to lay out how the borrowing situation works for Ratepayers across NZ, and we’ll try to do that in simple terms, from a very complex document.

After you have read this – once again – we ask you to share this far and wide.

We want as many ratepayers and renters as possible to know about this issue, so they know they need to vote differently at the election this year.

When everyone knows what a mess our NZ Councils are getting us into, and by association our central government, without our knowledge or permission, then we can do something about it. People can vote differently to remove the elected officials who love to keep borrowing money.

And people can ACT NOW to stop more debt being taken on with the 2 topics currently open for submissions – more money to be borrowed for Climate Change Adaptation and Water Done Well.

- So where does the money come from for the loans ?

In the case of NPDC, 95% of the loans are held with the Local Government Funding Agency (LGFA). Most NZ Councils have some lending with LGFA. LGFA was set up as a limited liability company following the enactment of the Local Government Borrowing Act 2011.

- Who owns LGFA ?

The LGFA governance structure is made up of the New Zealand Government (20%) and thirty councils (80%), the LGFA Shareholders Council (appointed by Government and Councils) and the LGFA Board of Directors. (NPDC has a 0.4% shareholding in this company).

We are told the Councils get a better interest rate for loans if they use the LGFA – around half a percent lower than standard lending rates. We are told the lending conditions are more favourable.

- We are about to explain these favourable terms – we’ll let the Ratepayers decide how favourable they are.

The link to the LGFA website is:

https://www.lgfa.co.nz/about-lgfa

Under the Investors tab there is a section called the Guarantee Arrangements. This is the bit that will surprise many ratepayers. People have been saying my house, in my town, is the collateral if the loans fail.

- We are sorry to inform everyone it’s actually worse than that.

The documents on the LGFA website are very complex legal documents. They cover guarantor’s and defaults – something like a mortgage document, but more complex.

When a NZ Council signs up to the LGFA, a portion of all the ratepayers yearly rates becomes a guarantee for all the loans held by the LGFA. This rates portion amount is established by the LGFA every year, and ratepayers are guarantors whether their Council holds a current loan, or not, with the LGFA.

Just by signing the document to be able to borrow from the LGFA, the ratepayers’ rates income can be used as a guarantee.

So, if a Council anywhere in NZ was to default on their loan, the ratepayers from all other Council regions become the guarantors who will pay off those loans. The debt to be paid is apportioned across all the ratepayers of all other Councils who have signed an LGFA guarantee deed.

Some people have been concerned if the NPDC can’t pay their debts then we may be in trouble with our homes in New Plymouth, for the New Plymouth loans. It turns out that we, the ratepayers all over NZ, are responsible for all the debt, for every other Council that belongs to the LGFA.

Renters don’t get off the hook with this arrangement either, as most of the Councils in NZ have signed up for this arrangement, so if rates go up hugely to pay off debt, then by default so will rents. And rents in all towns will go up through this, so it’s not a case of just moving to another town and renting there.

- All Ratepayers, all over NZ, are in trouble if LGFA loans start defaulting.

And extremely large sums of money are about to be borrowed by Councils all over the country for Climate Change and Water Done Well.

We’ve asked for guidance from several people before posting this story. There was some comment about this being a legally binding document so there is no point upsetting people about conditions in a contract that can’t be changed. It was also pointed out the LGFA has a AAA rating with credit agencies.

We know that 18 NZ Councils were downgraded with their credit ratings last year, NPDC being one of those with only $364 Million at that time. (We see in yesterday's media that amount has increased yet again).

What is really concerning is the NPDC has listed in their current LTP that they intend to borrow another $1 Billion over the next 10 years, for infrastructure that hasn’t been maintained over the last 20 odd years.

Many other Councils in NZ are also planning on borrowing enormous amounts of money for their infrastructure too. Councils will also be able to borrow from overseas investors for the first time, all guaranteed by the Ratepayers of NZ, through their rates income.

So what about the Shareholders who own this “Limited” Liability Company ? What do they pay if the loans default ?

The Majority Shareholder – with a 20% shareholding – The Crown – is mentioned in the very last line – Clause 19 of the Guarantee and Indemnity Document. It clearly states the deed is not guaranteed by the Crown (NZ Government).

- The risks for the loans currently held by the LGFA Company are held by Ratepayers across NZ.

Apparently the Long Term Plan (LTP) is the document that points out for the community what our Councils have planned, and we get to have a say on whether we want them to do those things in the LTP or not.

- We have to ask - where was this in an LTP - or in a newsletter - explaining all about what was being agreed to on the ratepayer’s behalf when this LGFA Deed was signed for New Plymouth in 2016 ?

This is like our neighbours deciding they will borrow money to renovate their house. They put their neighbours on each side of them down as the guarantors, just in case they can’t pay the loan back. But the lender doesn’t let the neighbours know they will have to pay if the loan defaults.

- We are being told the lending conditions for the LGFA are more favourable !!

With our recent story with Water Done Well, our 3 Taranaki Councils did not offer us the option of a Water Consumer Trust Company as they prefer to use LGFA Financing. They consider this financing to be more favourable.

- Favourable for who ? Do Ratepayer’s think it is favourable for them ?

This LGFA document signed by multiple NZ Councils is definitely legally binding, but the entire concept of this Government and Council funding agency model, and the lack of any consultation with ratepayers about implementing this model in 2012, is morally bankrupt.

- So, what do we do about this ?

- Share this story through Facebook.

- E-mail this story to people you know.

By making as many ratepayers and renters aware of the conditions our Council has created for us with debt, people become aware why it is so important to get rid of the current elected officials who keep voting to take on more and more debt.

Send a submission with the 2 open topics for Climate Adaptation and Water Done Well.

Some of the things you may like to tell the NPDC are:

- You do not want more debt.

- You want to get rid of the current debt, or refinance without using the LGFA.

- You do not want your rates to be a guarantee for all LGFA loans.

- You want to leave the LGFA.

- You want to reduce operating costs at the NPDC so debt is paid off faster.

- Or other ideas and thoughts you may have (politely/no swearing).

With Water Done Well some of the thoughts you may like to tell the NPDC:

- You do not want your rates income used as a guarantee through LGFA Funding.

- You do not want to guarantee every other LGFA Council loan in NZ from your rates income in New Plymouth.

- You want to stay with what we have for water infrastructure at the NPDC now, or you want a Consumer Trust, where the NPDC can’t borrow from the LGFA. (See our recent story with Water Done Well).

- Or other ideas and thoughts you may have (politely/no swearing).

Links are here for information about the 2 consultations:

Climate Adaptation Information:

https://haveyoursay.npdc.govt.nz/climate-adaptation-plan

Water Done Well Information

https://haveyoursay.npdc.govt.nz/local-water-done-well

It has been suggested to us the standardised forms on the Website Consultation Documents do not count any comments in the boxes which differ to the topic of that box. If you don’t agree with the topic your opinion isn’t counted. It has been suggested to us if you write your own e-mail/letter, and send that to the Council, those comments are counted.

You must put a title on each submission, either:

“Submission for the Climate Change Adaptation Plan”

or,

“Submission for Local Water Done Well”

You must put your name on the document.

E-Mail to

Or hand deliver to the front desk of the Council.

We need everyone to help to tell others our stories, so we have:

- A much greater presence of aware voters making choices for different candidates at this year’s election.

- A lot more people sending submissions to stop the current concepts which will substantially increase the debt, and the interest, ratepayers (and renters) will have to pay.

P.S We’ve attached the LGFA page signed on behalf of New Plymouth in 2016.

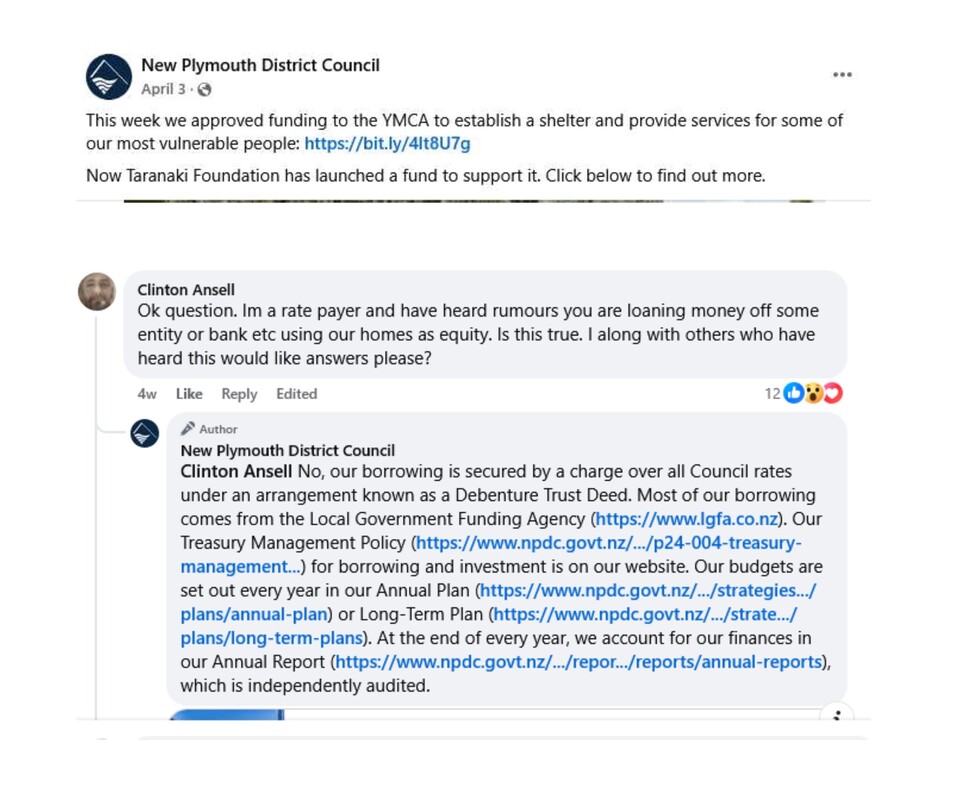

P.P.S We’ve also attached a question on the NPDC Facebook page about how the debt works with people’s homes. It seems like a fairly short and harmless reply in comparison to how this really works for ratepayers.

This is another time where the Alliance are asking for transparency (and a touch of honesty) from the people who are our elected officials.

Posted: Thu 08 May 2025